The Costa Rican Trust: Your Key to Private Lending and Problem Solving

For expats in Costa Rica, the fideicomiso (trust) is a key legal tool. Learn how to use it for seller financing on property, to borrow money, and to resolve legal disputes privately, bypassing the courts and protecting your assets.

For many expatriates in Costa Rica, securing a loan or facing a legal dispute can feel like an uphill battle. Fortunately, a powerful legal tool—the fideicomiso (trust)—offers a secure and efficient way to bypass traditional financing and lengthy court battles. A well-structured trust can serve as a potent financial vehicle, enabling creative borrowing solutions and offering a swift, private path to resolving contentious legal disputes outside the courtroom.

From large-scale real estate developments to personal financial arrangements, trusts provide a layer of security and flexibility that traditional contracts often lack. They are incredible instruments for anyone looking to invest, build, or simply protect their assets in Costa Rica. Here’s how you can leverage them to your advantage.

Understanding the Costa Rican Trust (Fideicomiso)

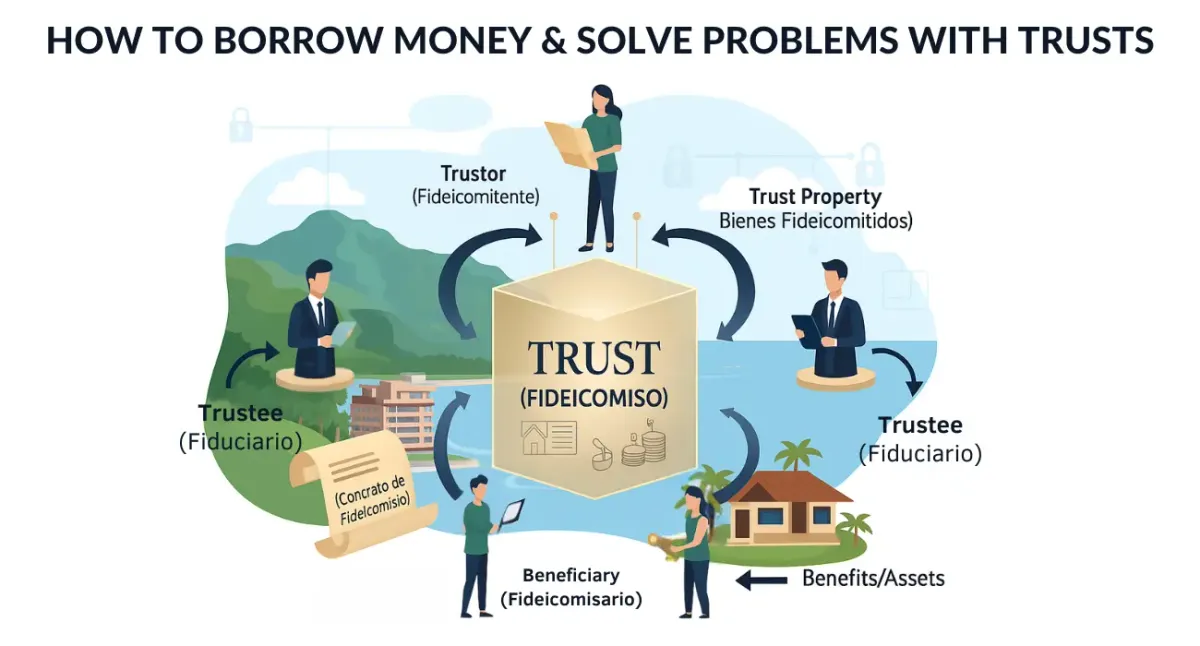

Before diving into specific examples, it’s essential to understand the basic structure of a fideicomiso. While the legal contracts can be complex, every trust is built upon five fundamental elements:

- The Trustor (Fideicomitente): The person or entity that creates the trust and transfers assets into it.

- The Trustee (Fiduciario): The neutral third party (often a lawyer, bank, or specialized trust company) that holds and administers the assets according to the trust's rules.

- The Beneficiary (Fideicomisario): The person or entity who will ultimately receive the benefits or assets from the trust. In many dynamic trusts, the Trustor and Beneficiary can be the same person.

- The Trust Property (Bienes Fideicometidos): The assets held within the trust. This can be anything of value—real estate, vehicles, cash, stocks, or company shares. A trust is not valid until property is placed into it.

- The Trust Contract (Contrato de Fideicomiso): This is the most critical component. It is the rulebook that dictates exactly how the Trustee must manage the assets, under what conditions they can be released, and to whom. While the possibilities are vast, the contract must be drafted with absolute precision. Any ambiguity in its terms can lead to disputes, undermining the very security the trust is meant to provide.

A key financial advantage of this structure is that moving an asset into a trust is generally not considered a final sale, but rather a transfer for administration or guarantee. This means the 1.5% property transfer tax is deferred, not due at the time the trust is created. The tax only becomes payable when the trustee ultimately transfers the property to a third party or a beneficiary who is different from the original trustor. If the asset is simply returned to the person who initially placed it in the trust, no transfer tax is incurred.

However, to benefit from certain legal protections and exemptions, especially within a guarantee trust (fideicomiso de garantía) used for lending, there are important regulatory requirements. Costa Rican law requires that any entity administering resources or acting as a trustee in a financial capacity must be a supervised financial institution (like a bank) or be registered with the financial regulator, SUGEF. This ensures compliance with anti-money laundering laws and provides oversight. Therefore, while the tax deferral is a general principle, ensuring your trustee is properly registered is a critical step for the trust's validity and security.

How to Borrow and Lend Money with a Trust

Trusts offer secure and creative alternatives to traditional financing, effectively bypassing the often-difficult process for expats to secure bank loans in Costa Rica. In fact, due to the security they provide lenders, trusts have now become the standard vehicle for most mortgages in the country, largely replacing the traditional mortgage structure (hipoteca). The reason for this shift is risk reduction: a trust allows a lender to reclaim a property upon default by simply executing a clause in the trust contract, bypassing the lengthy and uncertain court-supervised foreclosure process required for a traditional hipoteca.

Example 1: Seller-Financed Property Sale Imagine a retiring expat wants to sell their home to a newly-arrived family who doesn't have the residency status or credit history to qualify for a local bank mortgage. A traditional seller-held mortgage is risky; if the buyer defaults, the seller faces a lengthy and expensive foreclosure process in court.

The Trust Solution: Instead of a direct sale, the property is placed into a trust.

- The seller and buyer act as trustors.

- A neutral attorney acts as the trustee.

- The seller is the beneficiary of the monthly payments, and the buyer is the beneficiary of the property title, contingent on full payment.

The trust contract clearly states that if the buyer defaults on the payment plan, the property title automatically and immediately reverts to the seller. This structure effectively bypasses the judicial foreclosure process (proceso de ejecución hipotecaria) because the property title is already held by a neutral third party, not the buyer. A default simply triggers a contractual clause for the trustee to revert ownership, rather than requiring a court order to seize an asset from the debtor.

Example 2: Securing a Construction Loan A developer owns a prime piece of land but needs capital to build a condominium project. A bank is willing to lend the money but requires robust collateral.

The Trust Solution: The developer places the land title into a trust with the bank acting as the trustee or beneficiary. The trust contract stipulates that the construction loan funds will be disbursed in stages as construction progresses. As each condominium is completed and sold, a portion of the sale proceeds goes directly to the bank to pay down the loan. Once the corresponding payment is received, the bank, as trustee, is authorized to release the title of that specific unit to the new owner. This structure protects the bank's investment while creating a transparent and efficient process for transferring titles to buyers.

How to Solve Legal Problems with a Trust

Perhaps the most innovative use of a trust is in dispute resolution. By moving a contested asset into the hands of a neutral trustee, you can de-escalate a conflict and create a clear, enforceable path to a solution.

Example 1: Resolving a Common-Law Union Dispute When a common-law relationship ends acrimoniously, a dispute often arises over a shared home. One partner might file a legal claim to establish rights, effectively freezing the asset and initiating a court battle that could drag on for years.

The Trust Solution: Through mediation, the parties agree on a financial settlement. The property is then moved into a trust. The trust contract mandates that one party vacates the house immediately in exchange for a structured payout. The other party makes settlement payments to the trustee. Once the final payment is made, the trustee transfers the clean property title to the paying party, officially ending the agreement. Both parties avoid years of litigation and achieve a definitive, enforceable outcome.

Example 2: Finalizing a Property Sale with Bureaucratic Delays A buyer and seller agree on a price, but the deal is stalled because a crucial municipal permit or survey registration has not been completed. Neither party wants to walk away, but the buyer won’t release funds without a clear title, and the seller can't provide it yet.

The Trust Solution: The seller places the property into a trust, and the buyer places the purchase funds into the same trust. The contract instructs the trustee to execute the transaction automatically: once the final permit is officially registered, the trustee immediately transfers the property title to the buyer and the funds to the seller. The deal is secured, protecting both parties from uncertainty and delays.

Costs and Choosing a Trustee

The entity you choose as a trustee depends on the complexity of the situation.

- Attorneys/Notaries: For straightforward trusts like seller financing or simple dispute settlements, a reputable lawyer is often the most cost-effective option.

- Trust Companies: Specialized firms offer administration services and can be a good middle ground.

- Banks: For large, complex development projects, banks (like Banco de Costa Rica or Banco Improsa) offer the highest level of security and oversight, but also come with higher fees and more rigid requirements.

While the official attorney fee schedule suggests a low rate for creating a trust, the reality is that most lawyers charge between 1% to 3% of the asset's value, depending on the complexity. When getting a quote, ask for a clear breakdown of all potential charges. These typically include:

- Setup Fee: A one-time charge, often 1-3% of the asset's value.

- Annual Administration Fee: An ongoing fee, which may be a flat rate or a small percentage.

- Transaction Fees: Charges for specific actions, such as disbursing funds or transferring title. A clear, written fee schedule is essential.

Key Risks and Considerations

While powerful, trusts are not without risks. The effectiveness of a fideicomiso depends entirely on the integrity of the trustee and the clarity of the contract.

- Trustee Integrity: Choose a trustee with a long-standing, verifiable reputation. A dishonest or negligent trustee can mismanage assets or fail to act, creating a new legal problem.

- Contract Ambiguity: A poorly written contract with vague terms can be challenged in court, defeating the trust’s purpose. Every possible scenario, especially default conditions, must be explicitly and clearly defined.

- Complexity and Cost: While often cheaper than litigation, complex trusts still involve setup fees and ongoing administration costs. Ensure the financial benefit outweighs these expenses.

The Bottom Line: A Powerful Tool When Used Correctly. Trusts are a cornerstone of sophisticated financial and legal planning in Costa Rica. They offer unparalleled flexibility and security for everything from property financing to dispute resolution. However, their power is directly tied to the quality of the contract and the integrity of your trustee. Therefore, your most critical first step is not finding a property or a partner, but securing a legal expert with a proven track record in Rican trust law. With the right guidance, a fideicomiso isn't just a document—it's the key to achieving your financial goals and ensuring your peace of mind in paradise.