Property in Costa Rica: Why Putting It in Your Name Can Make Probate Expensive

Owning property in your personal name in Costa Rica can make probate costly. Learn about probate fees, taxes, and legal costs, and discover smarter estate planning options to protect your heirs and reduce expenses.

When purchasing real estate in Costa Rica, many buyers choose to register the property in their own personal name. While this may feel like the most straightforward approach, it carries a major hidden cost: probate.

If a property is titled in your personal name and you pass away, your heirs must go through the probate process in Costa Rica (proceso sucesorio) to transfer ownership. Probate here is not only mandatory—it can also be slow and expensive.

Understanding the true probate costs in Costa Rica before you buy can help you make better decisions about how to structure ownership and protect your estate.

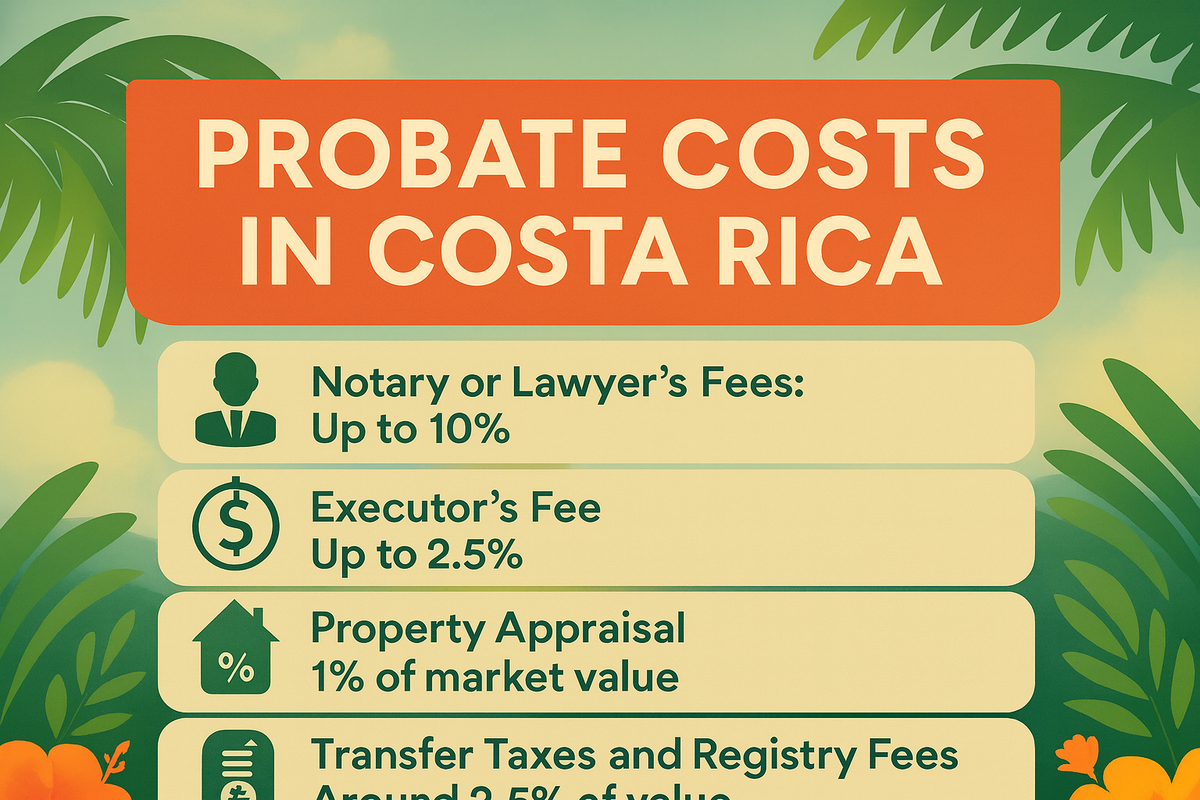

What Makes Probate So Costly in Costa Rica?

Unlike some countries where probate is relatively simple, Costa Rica’s system includes legally mandated fees, taxes, and court requirements. These expenses are calculated based on the total appraised value of the estate, meaning the higher the property’s value, the higher the costs.

Here’s a breakdown of the standard probate-related expenses:

1. Notary or Lawyer’s Fees (Arancel)

The attorney or notary overseeing probate charges fees set by law, based on a progressive scale:

- 10% on the first ¢15,000,000 of the estate’s value

- 7.5% on amounts over ¢15,000,000 up to ¢75,000,000

- 5% on any value above ¢75,000,000

2. Executor’s Fee (Albacea)

Every estate must have an Albacea (executor), appointed by the court, to manage the process.

- Fee: Up to 2.5% of the estate’s total value

- In some cases, an heir serving as executor may reduce or waive this fee.

3. Property Appraisal (Avalúo)

A licensed appraiser (perito valuador) must determine the property’s fair market value.

- Fee: 1% of appraised value

4. Transfer Taxes and Registry Fees

Once probate is complete, the property must be transferred into the heirs’ names. This is treated similarly to a property sale.

- Fee: Around 2.5% of the registered value

- Covers the transfer tax (impuesto de traspaso), stamps (timbres), and registry fees

5. Transfer Deed Fee and VAT

A notary must draft and register the final transfer deed (escritura de adjudicación).

- Fee: Calculated under Costa Rica’s notarial fee schedule

- VAT: 13% applied to both the deed and probate legal fees

6. Public Notices (Edictos)

The law requires a public notice (edicto) in the government gazette (La Gaceta) to notify potential creditors or heirs.

- Fee: About $100 USD (≈ ¢50,000)

Here is a comprehensive calculator to estimate the fees and costs of a Costa Rican probate:

Costa Rica Expertise

Estimated Probate Costs

Probate Costs Calculator

For Estates in Costa Rica

*This is an estimate based on a sample ₡515 exchange rate and official fee schedules. Costs can vary. Always consult with a qualified Costa Rican attorney for a formal quote.

Other Costs to Keep in Mind

Beyond the standard fees, property in your personal name can trigger additional costs during probate:

- Outstanding debts (loans, taxes, mortgages) must be settled before heirs inherit.

- Corporate restructuring fees if other assets are tied to companies.

- Ongoing property expenses like utilities, municipal taxes, and maintenance while probate is pending.

- Foreign documents (birth, marriage, death certificates) need apostilles and certified translations.

- Litigation fees if heirs contest the inheritance, turning probate into a lawsuit (proceso ordinario).

Why Estate Planning Matters in Costa Rica

For property owners in Costa Rica, the real lesson is this: holding property in your own name guarantees that probate will be required. And as the numbers show, probate is not cheap.

Smart buyers often explore alternatives such as:

- Holding property in a corporation

- Using a trust (fideicomiso)

- Creating a will or estate plan that anticipates Costa Rican probate requirements

These options can help reduce costs, save time, and ensure a smoother transfer of assets to your heirs.

Final Thoughts

Owning property in Costa Rica is a dream for many—but if you title it in your personal name, the cost of probate could turn that dream into a financial burden for your heirs.

Before making a purchase, consult with a qualified Costa Rican attorney who can help you understand your options and structure ownership in the most efficient way possible. A little planning now can save your loved ones significant money, stress, and delays later.