Meet OVi: The Secure Gateway to Costa Rica’s New Tax System

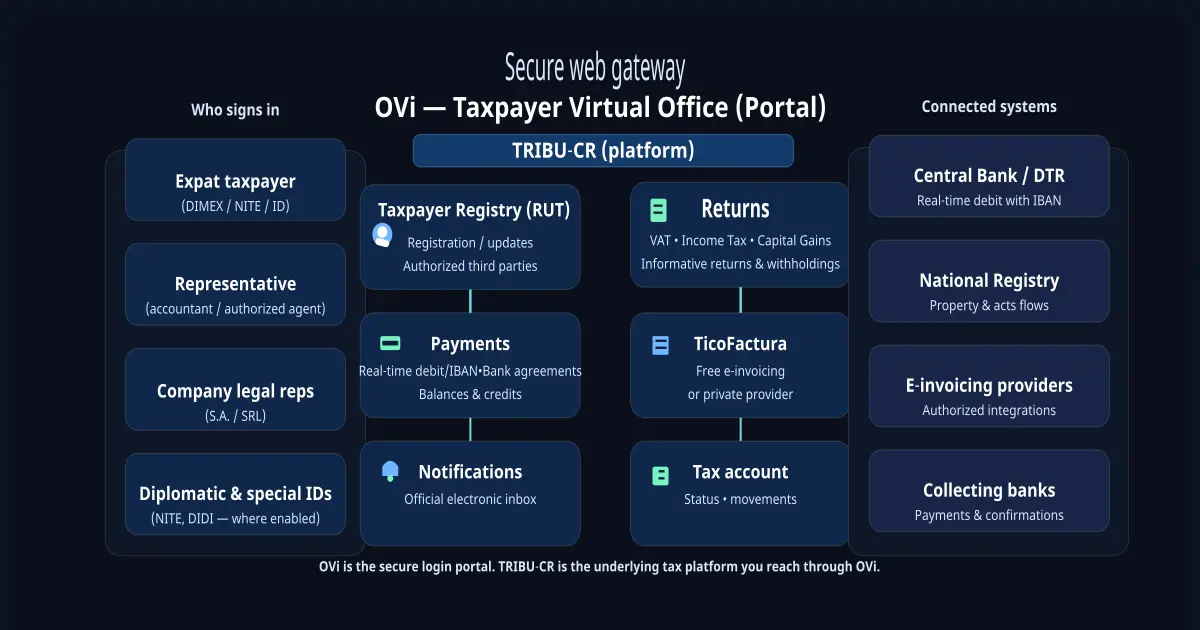

Costa Rica is launching a new digital tax era. Meet OVI — the secure portal where taxpayers, expats, and businesses manage everything in one place — and TRIBU-CR, the powerful system behind it. Safe, unified, and built for the modern taxpayer.

From cyberattacks to digital resilience — how Hacienda rebuilt its tax platform with stronger walls and smarter gates

A few years ago, Costa Rica’s government learned the hard way what digital vulnerability feels like. A major cyberattack crippled key institutions — including the Ministry of Finance (Ministerio de Hacienda) — disrupting online tax filings, customs systems, and payment portals for months.

That crisis became a wake-up call. If the country wanted a modern, transparent, and secure tax system, it needed to rebuild from the ground up.

This change affects everyone who pays taxes in Costa Rica — from individual salaried employees and self-employed professionals to large corporations and foreign investors with local tax obligations. For expats, this means a new way to interact with Hacienda’s digital systems: simpler, more unified, and far more secure.

The result: OVI and TRIBU-CR — the two pillars of Costa Rica’s new digital tax era.

OVI: The Guarded Front Door

Think of OVI (Oficina Virtual) as the front entrance to Hacienda’s new digital headquarters — a kind of secure bank lobby where guards check IDs and only verified visitors can proceed inside.

Everyone starts here. OVI is the secure login gateway for taxpayers — individuals, corporations, and non-residents — to access their tax information and services.

Just like a modern bank requires multi-factor authentication and encrypted access, OVI ensures that every taxpayer’s identity is verified before they can step into the more sensitive rooms inside.

This is where you log in, confirm who you are, and see your personalized dashboard: balances, filings, notices, and pending payments.

What You Can Do Inside OVI

Once you’re through OVI’s secure gate, everything you need as a taxpayer in Costa Rica lives under one roof. Here’s what’s inside:

- Taxpayer Registry (RUT): Register, update, or correct your taxpayer data and authorize third parties (like accountants or representatives) to act on your behalf.

- Returns: File all major taxes — VAT, Income Tax, and Capital Gains — plus informative declarations and withholdings.

- Payments: Make real-time payments through IBAN or linked bank accounts, view balances, and confirm credits.

- Notifications: Receive official messages and notices in a secure digital inbox.

- Tax Account: Monitor your tax status, transactions, and balances in real time.

- TicoFactura: Connect to Costa Rica’s e-invoicing system — either Hacienda’s free tool or a private authorized provider.

Behind the scenes, OVI connects directly to the Central Bank, National Registry, collecting banks, and authorized e-invoicing platforms — so your filings, payments, and property records stay synchronized automatically.

In short, OVI is the single access point for everything tax-related in Costa Rica’s new digital ecosystem.

TRIBU-CR: The Digital Core Inside

Once past OVI’s digital guards, taxpayers step into TRIBU-CR — the new Tax Management System (Sistema de Gestión Tributaria) at the heart of Hacienda’s modernization project.

TRIBU-CR replaces the outdated systems that served for years — ATV, TRAVI, EDDI-7, and DeclareWeb — each with its own interface, errors, and login quirks.

Here’s what changes:

- Unified System: All taxes are now managed from one platform.

- Cleaner Records: A single taxpayer registry consolidates data previously scattered across multiple databases.

- Faster Filings: Returns and payments are streamlined with pre-filled data and real-time validations.

- Secure Notifications: All official communications stay within the system — no risk of phishing or lost emails.

In short: TRIBU-CR is the modern vault where Costa Rica’s tax data now lives — OVI is how you enter it safely.

Why It Matters

This upgrade isn’t just about convenience; it’s about resilience.

When hackers paralyzed the old systems in 2022, Costa Rica was forced offline for weeks. The Ministry of Finance couldn’t even issue digital certificates or process filings.

OVI and TRIBU-CR were designed to ensure that never happens again. Built with modern encryption, cloud redundancy, and modular architecture, they aim to protect taxpayers’ data while giving Hacienda real-time insight into compliance and revenue flows.

For taxpayers, that means:

- Greater security for personal and financial data

- A single login for all tax obligations

- Faster responses and fewer breakdowns

- Less paperwork and fewer platforms to manage

For expats and foreign investors, it means smoother compliance: one portal to manage income declarations, real-estate taxes, or business filings — all in English-friendly formats and accessible from abroad with secure authentication.

What You Should Do Now

- The migration: Older systems like ATV have shut down starting October 2025.

- Register in OVI: Every taxpayer will need an OVI account for access. Use your cédula or DIMEX for authentication. Business owners and legal representatives should ensure their Digital Signature certificate (Firma Digital) is active, as it will be required for many corporate filings and sensitive actions.

- Update your RUT: Make sure your contact details (email and phone) are correct before the transfer.

- Back up old filings: Download declarations and receipts from ATV before it closes.

Final Word

Costa Rica’s move to OVI and TRIBU-CR isn’t just a tech upgrade — it’s a trust upgrade.

By investing in security, integration, and transparency, Hacienda is trying to restore confidence in its digital infrastructure.

Think of it this way: after the cyberattack, Costa Rica rebuilt its tax “bank.” OVI is the guard at the door. TRIBU-CR is the secure vault inside. And for the first time, taxpayers — including expats, entrepreneurs, and investors — can walk through the front door without fear the lights will suddenly go out.