Costa Rica Luxury Home Tax Explained: Exemptions and Misconceptions

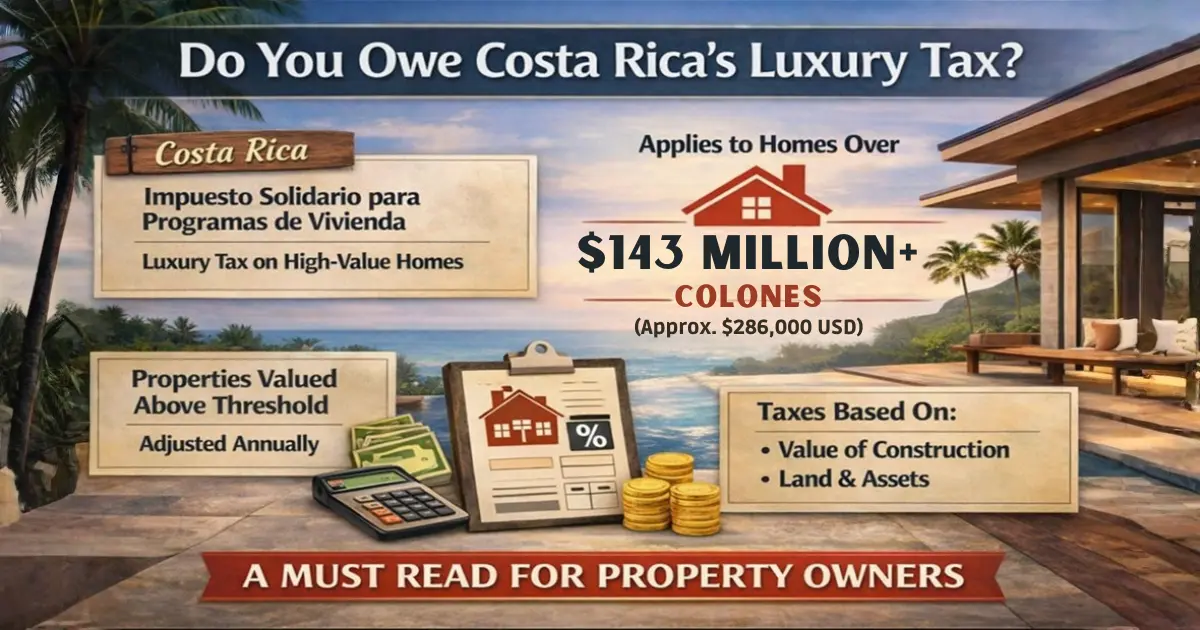

Costa Rica’s luxury home tax is widely misunderstood. Many properties are exempt. This guide explains who actually owes the tax, common misconceptions, how values are calculated, and what property owners should know before paying.

Costa Rica’s so-called “luxury home tax” is one of the most misunderstood taxes affecting foreign property owners. Many people assume it applies automatically to beachfront homes, high purchase prices, or any property that generates rental income.

In reality, the law is far more specific. Most properties people worry about are, in fact, exempt.

This article explains when a property is exempt, the most common misconceptions, how the tax is legally triggered, and how values are determined in practice.

What This Tax Actually Is

The tax is formally called the Solidarity Tax for the Strengthening of Housing Programs (Impuesto Solidario para el Fortalecimiento de los Programas de Vivienda).

It is a national tax, separate from municipal property tax, and it is evaluated once per year, based on ownership or qualifying rights as of January 1.

It applies only to certain residential-use properties and follows its own valuation rules and thresholds.

The Primary Exemption Rule

A residential property is exempt if:

The official fiscal value of the construction and fixed or permanent installations does not exceed the annual threshold established by decree.

For tax year 2026, that threshold is:

₡143,000,000 (construction value)

If the construction value is at or below ₡143 million, the property is fully exempt, regardless of:

- Purchase price

- Market or appraisal value

- Location

- Rental income

- Whether the home appears “luxury” in everyday terms

This single rule resolves most confusion.

Get clear, practical insights on life and business in Costa Rica.

Join our free weekly newsletter — ad-free, spam-free, and trusted by expats, investors, and retirees across Costa Rica.

How Much Is the Luxury Home Tax?

If a property is not exempt, Costa Rica’s luxury home tax is calculated using progressive rates ranging from 0.25% to 0.55%, depending on the property’s taxable value.

Only the portion of value within each bracket is taxed at the corresponding rate, not the entire value at once.

The tax is annual and is due by January 15 each year.

What “Construction Value” Includes

Hacienda does not evaluate only the main structure. The construction value includes:

- The primary building

- Fixed and permanent installations such as:

- Pools

- Ranchos and terraces

- Retaining or perimeter walls

- Built-in recreational features

- Internal paved roads

These items are often overlooked and can push a property above the threshold. If they do not, the exemption remains.

Depreciation Is Considered—With Important Limits

Yes, depreciation is part of the official fiscal construction valuation, but it is commonly misunderstood.

Hacienda does not use:

- Market depreciation

- Accounting depreciation

- Owner estimates

- Realtor or appraisal adjustments

Instead, it applies technical depreciation (depreciación técnica) using standardized parameters based on:

- The age of the structure

- Construction type and quality

- Defined useful-life tables

Important points to understand:

- Land does not depreciate

- Each structure and permanent installation depreciates independently

- Cosmetic condition has limited impact

- Depreciation cannot be accelerated or improvised

Because depreciation is built into the official methodology, older homes often remain below the threshold, while newer construction can cross it quickly.

Best Practice: Use an Experienced Engineer

Although owners are legally allowed to self-declare values, the most reliable way to determine the official fiscal construction value—especially when near the exemption threshold—is to use a licensed engineer or architect with experience applying Hacienda’s valuation parameters.

This is best practice, not overkill.

An experienced professional will:

- Apply standardized replacement-cost tables correctly

- Classify materials and construction quality accurately

- Apply technical depreciation exactly as Hacienda requires

- Separate taxable construction from non-taxable elements

- Provide documentation that holds up in administrative reviews

A standard real estate appraisal is not sufficient for this tax and often leads to incorrect conclusions.

Common Misconceptions

“My house cost a lot, so I must owe the tax”

False. Purchase price and market value are irrelevant. Only Hacienda’s fiscal construction valuation matters.

“Beachfront or gated homes always pay”

False. Location does not trigger the tax. A modest structure on valuable land may still be exempt.

“High land value triggers the tax”

False. Land value never triggers the tax by itself. Land is considered only after construction exceeds the threshold.

“All rental properties are automatically taxed”

Also false, but this point requires nuance.

Expert guidance for expats in Costa Rica.

Join our free weekly updates—practical, ad-free, and easy to read.

What Actually Triggers the Tax (Article 2 Explained)

Article 2 of the law defines the taxable event (hecho generador).

The tax is triggered by:

- Ownership, or

- Holding a right of use, enjoyment, or benefit (uso, goce o disfrute)

of a residential-use property (uso habitacional), located in Costa Rica, as of January 1, and used:

- Habitually

- Occasionally

- For recreation

Fixed and permanent installations are explicitly included.

The law focuses on use, not simply physical form or zoning.

Rental Use: Law Versus Administrative Practice

The law does not provide a blanket rental exemption. Renting a property alone does not remove it from the tax.

However, administrative practice matters in Costa Rica.

In practice, some properties used exclusively for documented commercial rental operations — with no personal residential enjoyment and full tax compliance carried out by a separate operating entity — have been treated by Costa Rica’s tax authority (Hacienda) as falling outside the scope of uso habitacional for purposes of the Solidarity Tax. This is not an automatic exemption and depends heavily on the property’s structure, documented use, and administrative enforcement discretion.

Where this treatment has been accepted, the facts typically include:

- No personal or recreational use by the owner

- Properties held as business assets

- A separate operating entity paying income tax, VAT, and payroll

- Formal agreements and consistent documentation

This treatment is not codified law and should never be assumed.

Important Caution

This approach:

- Is not guaranteed

- Is not automatic

- Does not apply to casual or mixed-use rentals

- Depends on structure, documentation, and enforcement posture

It should be evaluated carefully on a case-by-case basis.

The Correct Evaluation Sequence

A proper review follows this order:

- Determine the official fiscal construction value

- Apply technical depreciation under Hacienda’s rules

- Confirm whether the result exceeds ₡143,000,000

- Identify the nature of the property’s use

- Confirm ownership or qualifying rights as of January 1

Skipping steps is the source of most misinformation.

Final Takeaway

Most foreign property owners who worry about Costa Rica’s luxury home tax do not actually owe it.

The tax is narrowly defined, construction-value driven, depreciation-aware, and triggered only under specific legal and factual conditions. Rental use does not automatically exempt a property, but in limited, well-structured commercial scenarios, properties have been treated administratively as falling outside uso habitacional.

Understanding the difference between what the law says, how values are calculated, and how the tax is applied in practice is essential.

If you want help confirming whether your property is likely exempt—or determining its official fiscal construction value correctly—we can walk through the process step by step, clearly and responsibly.