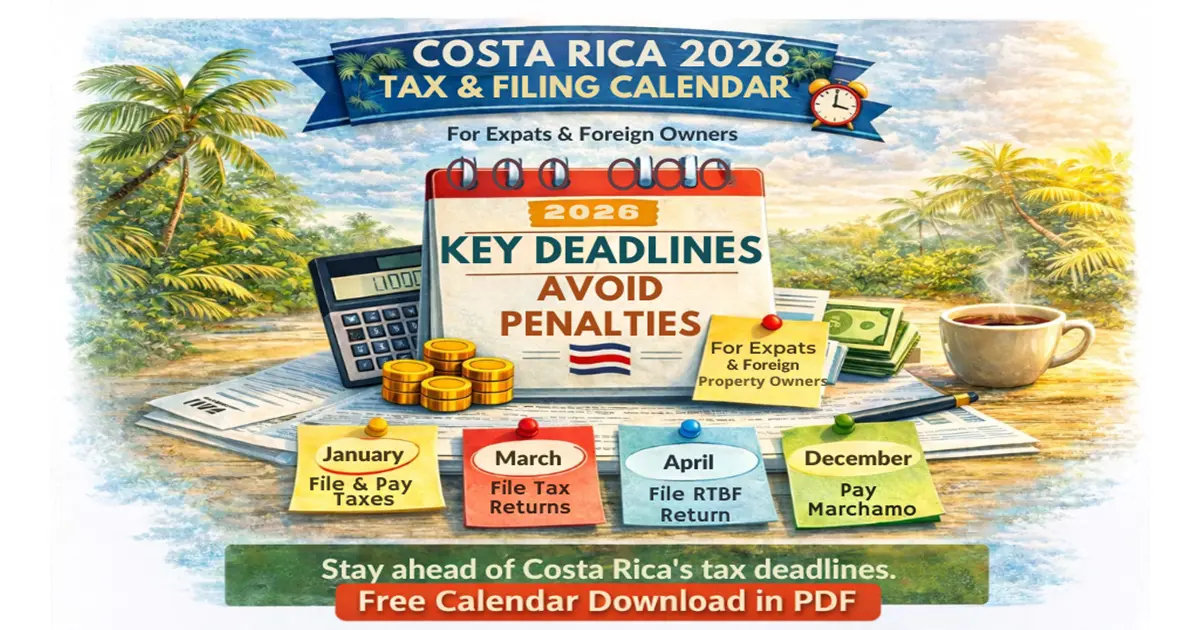

Costa Rica 2026 Expat Tax & Filing Calendar

A practical guide for property owners, inactive companies, and active businesses navigating Costa Rica’s 2026 tax and filing requirements. Understand what applies to you, when filings are due, and how to stay compliant without unnecessary complexity.

Living in Costa Rica is far easier when you understand how the country expects property owners, residents, and companies to stay compliant. The rules themselves are stable, but systems, form numbers, and reporting cycles evolve. Costa Rica now files taxes through TRIBU-CR, accessed via OVI. In 2026, accuracy means using the current system and understanding which obligations apply to your situation.

This guide is intentionally divided into three sections. Most expats only need to read one.

Section 1: Expats With Property Only (No Company)

Who this applies to

- You own a home or land in your personal name

- You do not own a Costa Rican company

- You do not rent or operate a business

This is the simplest category, but it still includes local obligations that are easy to overlook.

Your 2026 obligations

Municipal property tax

(Impuesto sobre bienes inmuebles)

- Usually payable quarterly:

- March 31

- June 30

- September 30

- December 31

- Managed by your local municipality, not the national tax authority

Get clear, practical insights on life and business in Costa Rica.

Join our free weekly newsletter — ad-free, spam-free, and trusted by expats, investors, and retirees across Costa Rica.

Municipal property value declaration (every five years)

Most municipalities require an updated property value declaration every five years. Unlike the tax payments above, this declaration is not annual. You must check when you last filed, as each property follows its own five-year cycle.

Missing an update can result in retroactive reassessments or penalties. Read our article on the subject here.

Luxury Home Tax

(Impuesto Solidario)

- TRIBU-CR Form 174

- Due January 15

- Applies only if the registered construction value exceeds the annual threshold

What does not apply

- Corporate entity tax

- Beneficial Ownership Registry (RTBF)

- IVA filings

- Income tax returns

Takeaway:

For property-only owners, compliance is local, periodic, and manageable—especially if you track the five-year valuation cycle.

Section 2: Expats With an Inactive Company (S.A. or S.R.L.)

Who this applies to

- You own a Costa Rican corporation

- The company holds property or exists for asset-holding or legacy reasons

- No income, no invoices, no commercial activity

This is the category where expats most often encounter silent compliance issues.

Your 2026 obligations

Annual corporate entity tax

(Impuesto a las Personas Jurídicas)

- Processed as TRIBU-CR Form 169

- Due January 31

- Applies even with zero activity

This obligation functions primarily as a payment, not a traditional tax return. In OVI, this often appears as a direct payment obligation rather than a form you must fill out from scratch.

Informative return for inactive entities

- TRIBU-CR Form 272

- Filed in March

- Confirms the company had no economic activity

- One of the most commonly missed filings by expats

Beneficial Ownership Registry (RTBF)

- Filed annually during the officially announced window

- Usually due in April, but the exact window is set each year and can change

- Filed by the legal representative or an authorized attorney

- Requires accurate shareholder and control information

Corporate records

- Shareholder registry must be current

- Legal representative must be valid and reachable

- Corporate books must exist and be properly maintained

What usually does not apply

- IVA filings (unless voluntarily registered)

- Income tax returns (utilidades)

- Municipal business licenses (patente)

Takeaway:

Inactive companies remain fully visible to the state. Missing Form 169, Form 272, or the RTBF filing is how small oversights turn into expensive problems later.

Expert guidance for expats in Costa Rica.

Join our free weekly updates—practical, ad-free, and easy to read.

Section 3: Expats With an Active Company

Who this applies to

- You earn rental income

- You provide services or consulting

- Your company issues invoices or receives payments

This category benefits most from routine and consistency.

Your 2026 obligations

Monthly Value-Added Tax (IVA)

- TRIBU-CR Form 150

- Due within the first 15 calendar days of the following month

Monthly informative reporting

- Filed monthly, generally within the first 10 calendar days of the following month

- Reports required economic and transactional information

- Applies even in low-activity months

Annual income tax return

- Individuals: TRIBU-CR Form 101

- Companies: TRIBU-CR Form 102

- Due March 15 (or the next business day)

Annual corporate entity tax

- Processed as TRIBU-CR Form 169

- Due January 31

Beneficial Ownership Registry (RTBF)

- Filed annually during the officially announced window

- Historically April, but always confirm the year’s resolution

Municipal business licenses (patente)

- Required when activity is subject to local licensing

- Renewal rules vary by municipality

Takeaway:

Active companies succeed in Costa Rica through monthly discipline, not last-minute corrections.

A note on dates and flexibility

Costa Rica’s deadlines are firm, but:

- Some filing windows (such as RTBF) change with little warning.

- If a due date falls on a weekend or public holiday, it typically moves to the next business day

Ultimately, the taxpayer bears sole responsibility for tracking these dates, regardless of reminders.

Final takeaway

Costa Rica does not demand perfection.

It expects order, consistency, and awareness of what applies to you.

If you know your category—and keep a simple calendar—compliance becomes routine rather than stressful.

Have questions about your Costa Rica tax or filing obligations?